The Economic Stimulus Act of 2008 - What businesses need to know. |

On February 13, 2008, H.R. 5140, otherwise known as the Economic Stimulus Act of 2008, was signed into law. The act was written by lawmakers in response to a shaky economy, and is geared towards heading off a recession.

While the biggest headline grabber of the act is the $600 rebate checks that most Americans will get, the act also includes several very generous provisions for businesses – provisions that should greatly encourage businesses of all sizes to invest in themselves by buying new equipment.

Modifying Section 179

In a nutshell, the "business side" of the Economic Stimulus Act of 2008 largely seeks to enhance and expand Section 179, which is a section of the US tax code that allows businesses to deduct the full amount of certain equipment purchases during the tax year they were bought.

To give a good example of how section 179 works, say a business purchases qualifying equipment for $100,000. Section 179 dictates they can deduct the full $100,000 for the current tax year. This gives businesses an incentive to purchase new equipment.

However, until now, the "cap" on equipment purchase deductions was $128,000, and the total cost of equipment purchased could not exceed $510,000. The Economic Stimulus Act of 2008 has almost doubled the deduction cap, to $250,000, and raised the overall total cost to $800,000.

Twice as Nice

In other words, a business can write off the full purchase price of almost TWICE the amount of qualifying equipment in 2008 as it could in 2007. The equipment must be put into use between Dec 31, 2007 and Jan 1, 2009, so this provision is definitely aimed to spur business purchases made in calendar year 2008.

Another change that the Economic Stimulus Act of 2008 brings is it offers a one-time "bonus first year depreciation" of 50% on qualifying equipment. This is after the above deduction limit is reached.

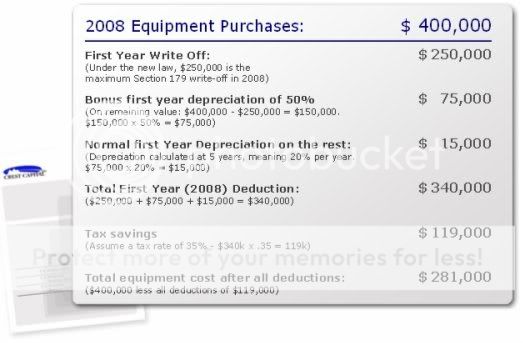

To show the effects this could have, let's give a quick example:

On February 13, 2008, H.R. 5140, otherwise known as the Economic Stimulus Act of 2008, was signed into law. The act was written by lawmakers in response to a shaky economy, and is geared towards heading off a recession.

While the biggest headline grabber of the act is the $600 rebate checks that most Americans will get, the act also includes several very generous provisions for businesses – provisions that should greatly encourage businesses of all sizes to invest in themselves by buying new equipment.

Modifying Section 179

In a nutshell, the "business side" of the Economic Stimulus Act of 2008 largely seeks to enhance and expand Section 179, which is a section of the US tax code that allows businesses to deduct the full amount of certain equipment purchases during the tax year they were bought.

To give a good example of how section 179 works, say a business purchases qualifying equipment for $100,000. Section 179 dictates they can deduct the full $100,000 for the current tax year. This gives businesses an incentive to purchase new equipment.

However, until now, the "cap" on equipment purchase deductions was $128,000, and the total cost of equipment purchased could not exceed $510,000. The Economic Stimulus Act of 2008 has almost doubled the deduction cap, to $250,000, and raised the overall total cost to $800,000.

Twice as Nice

In other words, a business can write off the full purchase price of almost TWICE the amount of qualifying equipment in 2008 as it could in 2007. The equipment must be put into use between Dec 31, 2007 and Jan 1, 2009, so this provision is definitely aimed to spur business purchases made in calendar year 2008.

Another change that the Economic Stimulus Act of 2008 brings is it offers a one-time "bonus first year depreciation" of 50% on qualifying equipment. This is after the above deduction limit is reached.

To show the effects this could have, let's give a quick example:

As you can see, the effects of the new legislation can be profound. In this example, $400,000 worth of qualifying equipment has a true cost of only $281,000.

Of course, the above example is hypothetical, but there's no mistake that the Economic Stimulus Act of 2008 makes it very attractive for a business (that needs equipment anyway) to perhaps buy a little more equipment in 2008. The government has set an attractive table, and it is their hope that businesses will sit down to feast.

Do you want to know how you can make this important tax change work for you? Then contact Crest Capital for a free consultation to maximize your equipment investment dollars. You can also learn about options that can enhance your 2008 tax savings with a free instant quote today.

As you can see, the effects of the new legislation can be profound. In this example, $400,000 worth of qualifying equipment has a true cost of only $281,000.

Of course, the above example is hypothetical, but there's no mistake that the Economic Stimulus Act of 2008 makes it very attractive for a business (that needs equipment anyway) to perhaps buy a little more equipment in 2008. The government has set an attractive table, and it is their hope that businesses will sit down to feast.

Do you want to know how you can make this important tax change work for you? Then contact Crest Capital for a free consultation to maximize your equipment investment dollars. You can also learn about options that can enhance your 2008 tax savings with a free instant quote today.